The Benefits of Dollar-cost Averaging in Crypto

Learn about dollar-cost averaging (DCA) and how to make smaller, equal investments in crypto regularly

By

•

10min

•

Jan 26, 2025

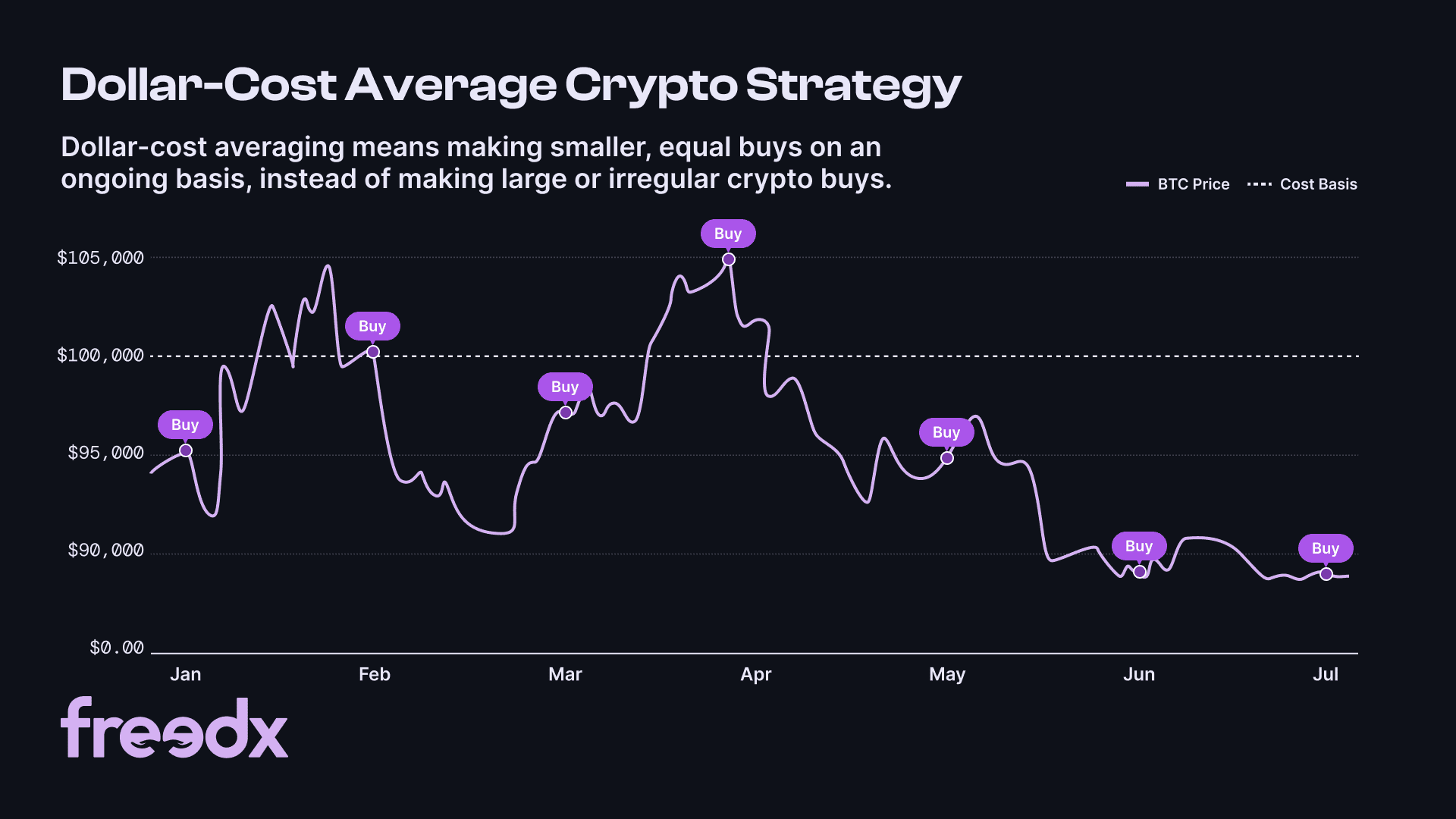

Dollar-cost averaging (DCA) is a popular investment strategy where you buy cryptocurrency in small increments over time instead of all at once. It reduces risk by spreading out purchases and eliminating emotional decisions based on market fluctuations. DCA is suitable for traders who want to HODL and build a long-term position in crypto without needing to time the market for the optimal entry point.

But how does dollar-cost averaging work in crypto trading? Let’s take a look.

1. What is dollar-cost averaging?

Dollar-cost averaging is a strategy that consists of making smaller, equal investments on an ongoing basis. Instead of spending a lot of money and placing large irregular orders, you make smaller, consistent purchases.

This investment strategy was first applied with traditional equities, but it also works well for cryptocurrencies, which are notoriously volatile. By regularly buying specific coins, you’ll be able to buy more of an asset no matter what’s going on in the crypto market. This way, your holdings grow steadily over time while you lower your overall cost-basis during dips.

You are essentially "averaging out the cost" of the target crypto assets.

DCA also helps in reducing the need to "time the market" because you consistently accumulate an asset over time instead of spending a large lump sum at once. Keep in mind that dollar-cost averaging doesn’t guarantee profit or prevent loss, but helps you accumulate assets over time at an average cost.

2. How dollar cost averaging works

DCA is an easy and useful way to build up your holdings gradually. The strategy focuses on consistent and careful allocation of resources, especially useful in periods of market volatility.

If you have $50,000 to invest in bitcoin and the current price is $105,000, buying all at once gets you 0.476 Bitcoin.

But if you split your $50,000 into five $10,000 purchases at prices like $105,000, $100,000, $90,000, $95,000, and $110,000, your average cost drops to $100,000, and you end up with 0.5 bitcoin.

By spreading out your investment, you get more bitcoin overall and can benefit more when prices go up. This is the advantage of dollar-cost averaging.

3. Benefits of Dollar-cost averaging in cryptocurrency trading

Cryptocurrencies are very volatile, similar to penny stocks. Small-cap cryptocurrencies (under $2 billion market cap) are especially sensitive to big trades.

Large investors, called "whales," can move prices significantly in these smaller markets. They might create fake buy or sell walls to trick others into trading, then make big moves to profit from the price changes.

Even mid-cap cryptocurrencies (up to $10 billion market cap) can be affected by these trades.

Unlike stocks, which are valued based on a company's products and costs, cryptocurrencies are mostly valued as a median of exchange, store of value, tokenization of RWA (real world assets), scalability of networks, and decentralization. They also have value through speculation and their potential to improve or replace traditional finance.

Dollar-cost averaging (DCA) can help you manage risk by spreading out investments over time, taking advantage of market volatility.

For example, if you choose to invest $100 in bitcoin each month, you will stick to that plan no matter what the price is. If the price is high, you will get fewer Bitcoins with your allocated amount of money. If the price is low, you will get more with the same amount. Gradually, this can lead to a lower cost for each Bitcoin than paying a large amount all at once.

This way, you are buying at both high and low prices, potentially lowering the average cost and increasing gains compared to investing everything at a single high price.

Key takeaways:

- It works with any investment amount, whether $10, $100, $1,000, or more, depending on your budget.

- It’s effective in both rising (bullish) and falling (bearish) markets, as long as investments are consistent over time.

- However, DCA requires confidence in the asset's fundamentals, as the strategy is built on making regular, fixed investments.

4. Pros vs Cons of Dollar-cost averaging

DCA advantages

- DCA focuses on long-term gains, making it less likely for investors to panic-sell during price drops.

- It cultivates disciplined investing by allocating small amounts regularly, taking emotion out of the process.

- DCA reduces the need to rely on unreliable technical analysis, so you can invest steadily based on confidence in the asset.

- DCA helps diversify risk across different cryptocurrencies by spreading investments over time.

- Dollar-cost averaging encourages a steady, disciplined approach to crypto investing regardless of market conditions.

- DCA does not prioritize profit so returns may be lower during a prolonged bull market compared to a lump-sum investment.

- DCA requires more frequent trades, which can result in accumulating transaction fees on some crypto platforms.

- The strategy may not be suitable for investors who can afford large lump sums upfront to take advantage of bull markets.

5. How to DCA crypto

If you feel ready to try dollar-cost averaging with crypto, there are a few other things to consider before jumping in. Here's how to DCA crypto successfully:

Choose a cryptocurrency

Before applying the dollar-cost averaging strategy to any cryptocurrency, you should do your own research (DYOR) on the selected asset.

DCA is a long-term investment strategy, so it is not recommended for day traders who speculate on short-term price volatility.

Look into the history of the cryptocurrency you have chosen. Examine the project, the team, the whitepaper and other documents, and the utility of the coin. The goal of DCA is to consistently accumulate an asset over several months or years, so those cryptocurrencies should be able to demonstrate longevity in the market.

Evaluate current market trends and consider the sentiment surrounding cryptocurrency before applying DCA to it. Metrics like trading volume, liquidity and historic price performance are important to develop a deeper understanding of the asset and its potential risks.

Set an order amount

Before dollar-cost averaging a digital asset, you need to be aware of your financial circumstances and goals.

Cryptocurrency investing is risky and markets are volatile. While dollar-cost averaging reduces this risk, it cannot eliminate it completely. Never invest money you cannot afford to lose.

Always consider:

- Asset risk and volatility: This will help you determine the amount of money you’re comfortable with allocating towards DCA.

- Essential expenses: Keep track of your monthly costs to calculate a reasonable amount for cryptocurrency investing without compromising your financial standing.

- Budget: A good basic rule in trading crypto for beginners is to not allocate more than 10% of your savings towards cryptocurrency investment.

DCA does not require you to time the crypto market. The timing of the asset purchase depends entirely on your preferences and goals.

You can start by researching the historical price performance of a cryptocurrency and pinpoint the optimal times to buy each day, week or month.

With DCA, you're setting up a recurring buy and your card will be charged at your chosen frequency until canceled. While recurring buys can simplify your strategy and build up your portfolio, keep in mind that they execute at market prices and may not always reflect the potential benefits of manually placed market or limit orders. You can cancel at any time to adjust your strategy as needed.

6. Ready to start dollar cost averaging?

Dollar-cost averaging is a convenient and easy approach for new traders who want to build their crypto portfolio.

If you're considering DCA, assess your financial situation, determine your financial goals and risk tolerance. We recommend you do your own research and learn about cryptocurrencies and trading before implementing this strategy.

Register on Freedx and start building up your crypto portfolio .

Platform usage is subject to successful onboarding and KYC. Freedx services may be limited / not available in certain countries.