2024: A Year in Crypto Highlights

The milestones that defined the crypto market in 2024. From Bitcoin breaking the $100K barrier to new regulations and trends.

By

•

10min

•

Jan 01, 2024

2024 was a defining year for crypto. It marked the fourth bull market, driven by new trends like Bitcoin and Ethereum ETFs, Layer 2 blockchain improvements in scalability and applications, real-world asset tokenization and the Bitcoin halving. We also saw significant progress in regulations and institutional adoption, setting the stage for the next major growth phase for cryptocurrencies.

## 1. Top Crypto Events in 2024

## 1. Top Crypto Events in 2024

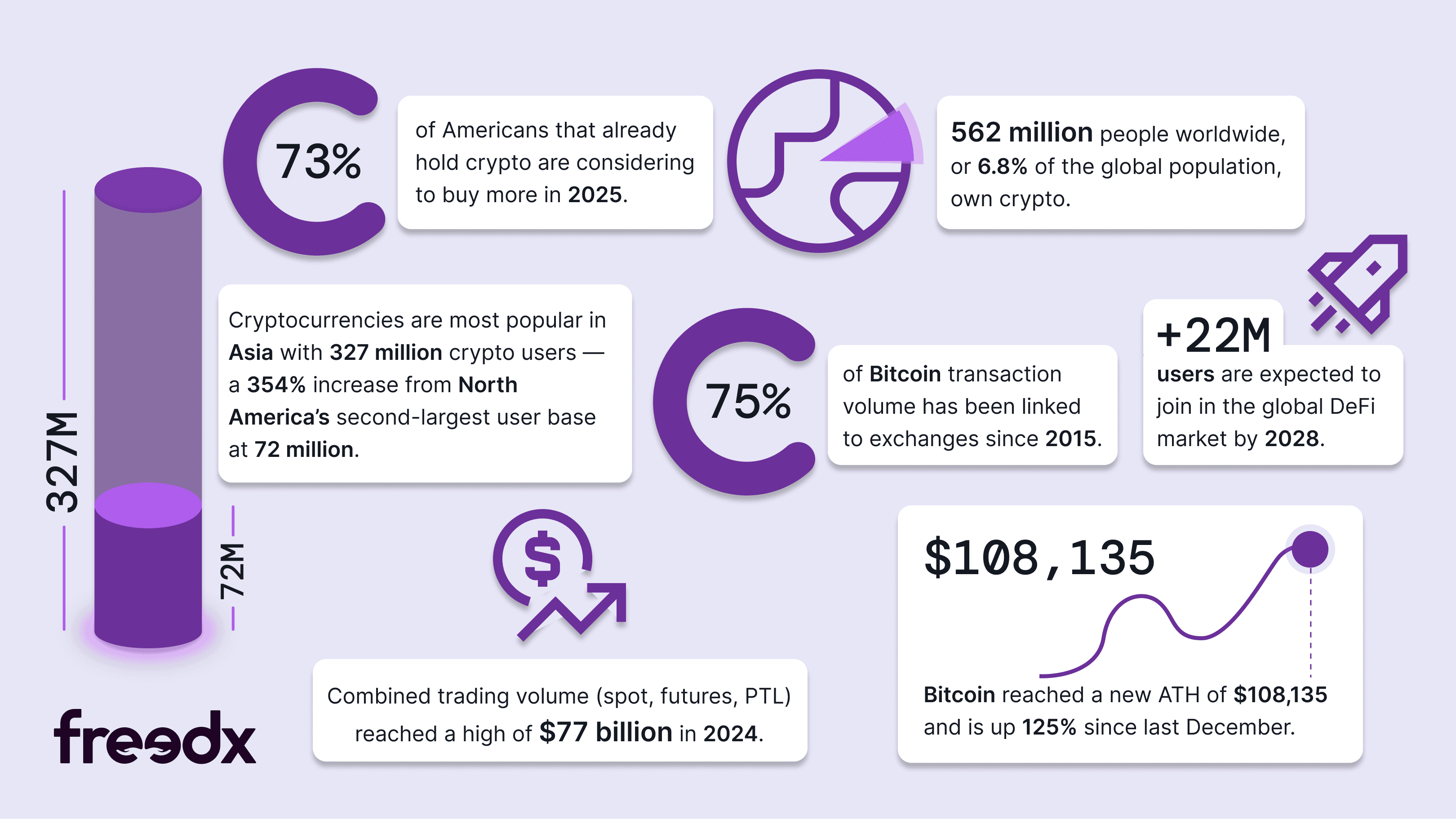

- On December 17, 2024, Bitcoin hit a new all-time high of $108,135, driven by the approval of spot Bitcoin ETFs and increased institutional investment. Breaching the barrier of $100,000 for the first time was a significant milestone in increased confidence among individual and institutional investors and growing regulatory acceptance. Confirming Bitcoin's significance as a hedge against inflation and cementing its status as "digital gold" in what many see as a new era for crypto.

- In January 2024, the SEC approved spot Bitcoin ETFs from BlackRock, Fidelity, and Ark Invest, giving institutional investors a regulated way to buy Bitcoin. This milestone drove Bitcoin’s price surge and brought billions in new investments into the crypto market.

- The SEC approved Ethereum ETFs on May 23, 2024, with corporations such as BlackRock and Fidelity among those who received the green light. Trading began in July 2024, opening the door for institutional investors to benefit from direct exposure to Ethereum via regulated financial products. This confirmed the status of Ethereum as a financial instrument, cementing Ethereum's role in decentralized finance (DeFi).

- ETFs hit the market with record-breaking success, with billions of inflows into BTC and ETH, making crypto a part of traditional portfolios.

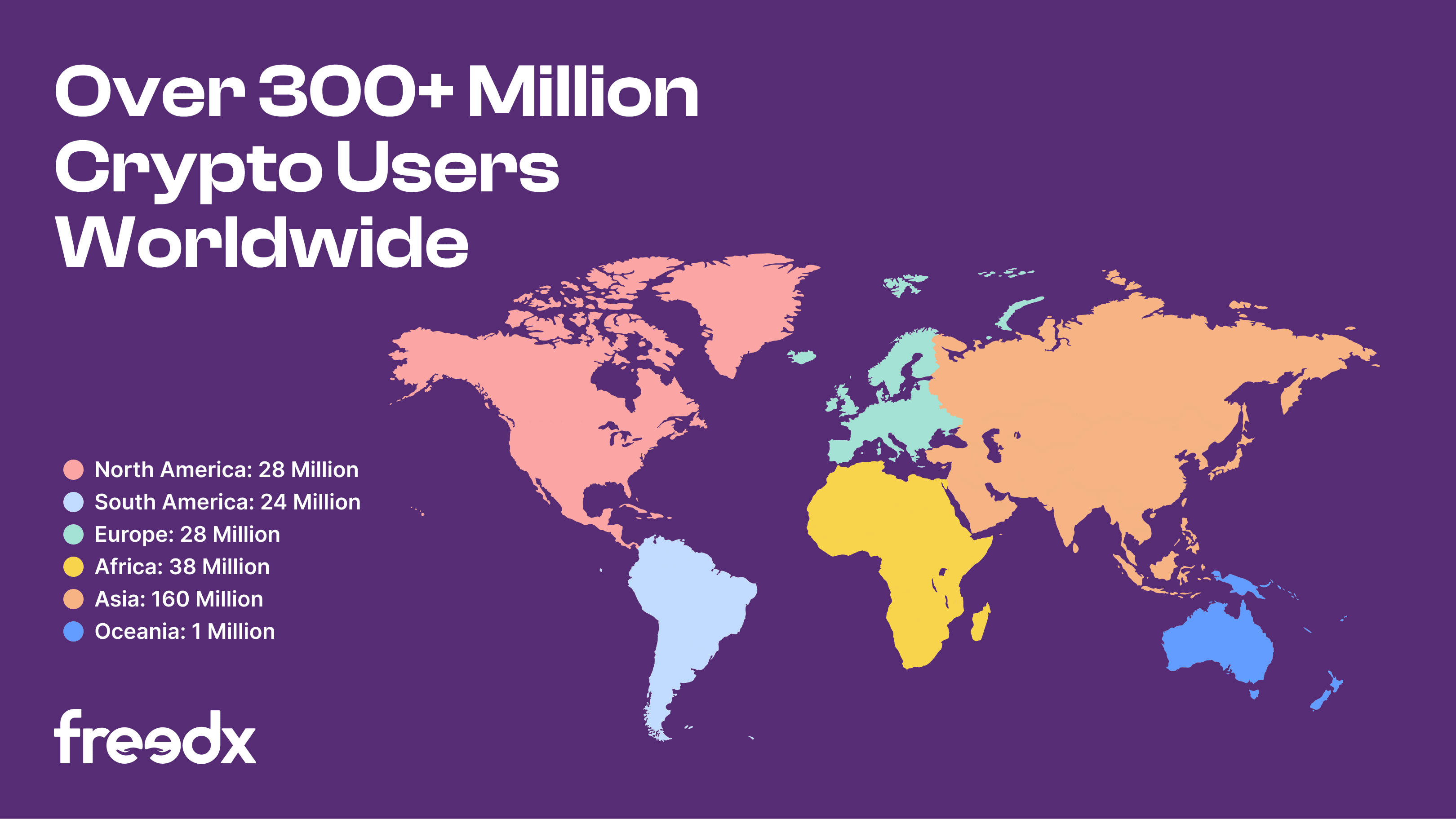

- The global cryptocurrency market grew massively in 2024, jumping from $1.6 trillion in January to $3.9 trillion by December – more than doubling its value. This surge reflects renewed investor confidence and increased adoption from regulatory bodies, institutional and retail investors alike.

- 562 million people now own crypto worldwide, representing 6.8% of the global population, highlighting crypto's growing appeal as an investment, payment method and a hedge against inflation.

- In the U.S. alone, 40% of adults now own crypto, a 10% increase from 2023. Additionally, 63% of crypto holders plan to buy more in the light of Trump's pro-crypto stance.

- Bitcoin remains the most popular crypto, held by 76% of investors. Ethereum follows with 54% ownership, though this is a drop from 65% in 2022, showing shifting interests in the market.

- Stablecoins peaked in popularity in 2022, with the top 10 reaching a combined market cap of $152 billion with many banks looking to tap into the billion-dollar stablecoin market to rival Tether’s dominance.

- The global DeFi market is set to grow to 22 million users (about the population of New York) by 2028, up from 18.9 million in 2024, attracting unbanked and underbanked people seeking global, affordable, and fast financial services.

- Female crypto ownership in the U.S. rose to 29% in 2024, up from 18% in 2023. Male ownership increased to 49%. Gender gaps are narrowing as more women enter the space.

- Asian Americans lead U.S. crypto ownership, with 11% owning crypto, mainly for investment purposes. They outpace other racial groups in adoption driven by the crypto-forward sentiment and regulations dominating the APAC region.

- South America saw a 116.5% increase in crypto adoption between 2023 and 2024, the fastest growth globally.

- The United Arab Emirates has the highest crypto ownership rate globally, with 25.3% of the population owning some amount of crypto.

- The average crypto investor in the U.S. earns $7,467 per month, while non-crypto owners average $6,648 per month.

- Lower-income Americans earning $25,000 or less are the demographic most likely to use crypto as a medium of exchange for transactions at 4%, compared to 1% of higher-income households.

- Centralized crypto exchanges remain strong with Binance leading with $21.6 billion (about $66 per person in the US) in deposits. Decentralized exchanges also hit a record-breaking $463B in trading volume this December, indicating increased adoption and interest in cryptocurrency markets.

- Crypto losses due to exploits in 2024 hit $1.49B—a 17% drop from 2023’s $1.8B. While this decline is encouraging, threats persist with DMM Bitcoin & WazirX being the year’s biggest victims, accounting for $540M (36% of all losses).

Real-world asset (RWA) tokenization became a real trend. Jumping from $8.5B to $14. 8B in 2024 with major players like JP Morgan and BlackRock driving institutional adoption. Tokenized treasures alone reached $4B.

Donald Trump embraced crypto as part of his Presidential Campaign, winning over investors, entrepreneurs, and users frustrated with regulatory crackdowns. The US President made several pro-business and crypto appointments, spoke at the Bitcoin 2024 conference, launched NFTs, and even introduced his own crypto project, World Liberty Financial.

In 2024, Solana overtook Ethereum, becoming the top blockchain for on-chain culture and decentralized finance (DeFi), powering 81% of all DEX transactions and 64% of NFT mint transactions across blockchains. The growth was driven by meme coins, developer adoption and its high transactions-per-second (TPS) capabilities.

AI merged with meme coins to mark the start of a new billion-dollar market with the first AI-created meme coin GOAT soaring over 500% in one week.

Starting as jokes, meme coins delivered 2,185.1% returns this year. Viral trends like BRETT and POPCAT made fortunes but also highlighted the volatility of chasing trends.

Institutional moves shaped the crypto narrative with Marathon Digital Holdings acquiring over 15,000 BTC and Hut 8’s $100 million Bitcoin purchase. MicroStrategy finished 2024 with a holding of 446,400 bitcoin after its last buying spree.

In December 2024, BlackRock, an asset manager with over $11.5 trillion in assets under management, advised its investors to put 1-2% of their portfolios in Bitcoin.

Ripple Labs debuted its own USD-backed stablecoin, RLUSD, following permission from the New York Department of Financial Services (NYDFS). RLUSD is backed by US dollar reserves or cash equivalents, rivaling established players like Tether (USDT) and USD Coin (USDC).

Crypto.com launched its U.S. trust company, Crypto.com Custody Trust Company, offering custody services to eligible U.S. and Canadian institutions and high net worth clients. The exchange also integrated with the Salvation Army to allow customers in Singapore to make donations in their favorite cryptocurrencies.

Ripple’s SEC case success bolstered XRP and crypto optimism.

The EU established crypto regulations, fostering adoption and global clarity, with MiCA - the world's first most comprehensive legal framework for crypto and blockchain.

90% of all cash used for crypto transactions was deposited into crypto exchanges with nearly all of it passing through checking accounts before being exchanged into crypto.

2. What's Next for Crypto In 2025?

The crypto market is evolving rapidly and is on a trajectory to grow by a factor of ten or more in 2025 thanks to institutional investment, more blockchain use cases, and better regulations. Industry experts are noting an increase in confidence from retail investors in the capacity of blockchain to scale and find real-world applications. Real-world asset tokenization is making digital assets more commonplace, hinting at the potential of integrating AI, and the possibility that tech giants like Amazon and Google will accept crypto.

In terms of rules and regulations, the fact that crypto will be allowed in 401(k) plans and expected U.S. policies show that things are becoming safer and more legal. Crypto's role in global banking will grow as more countries add Bitcoin to their reserves and more people use the Lightning Network.

Blockchain is changing more than just money; it's also reshaping business, government, and technology. The possibilities are endless, from making it possible to send money across borders to managing fractional control and keeping data safe with AI. When blockchain, AI, and IoT all work together, they will set the stage for new business models and speed up growth in all fields.

The crypto market is transitioning, with 2025 set to be a year of exponential growth. Increased institutional involvement, broader blockchain applications, and greater regulatory clarity will drive the space forward. The future of crypto looks promising, and 2025 could mark a pivotal year in its evolution. Decentralized finance (DeFi), tokenized assets, and blockchain technology will be important parts of the world's financial system by 2025.

3. Get Started with Freedx

Crypto adoption, earnings, and value saw significant growth in 2024, signaling a strong positive outlook for the industry. If you're looking to learn more about cryptocurrencies and blockchain technology, Freedx helps you stay informed about all things crypto.

Register and start your crypto journey today.